MURICO.com Forum

7/15/14 UP again by +$0.53. The model projects that the CME Index component on the 7/15/14 kill will scoot up between 0.40 and 0.70. The model projects that the cash settlement index for the NNNs will be about 134.075. The model turned out to be nice trading tool for the NNNs and gave me the "Spine" I needed to go to cash settlement long the NNNs. Generally the closer we get to cash settlement, the more powerful the model is as a trading tool.

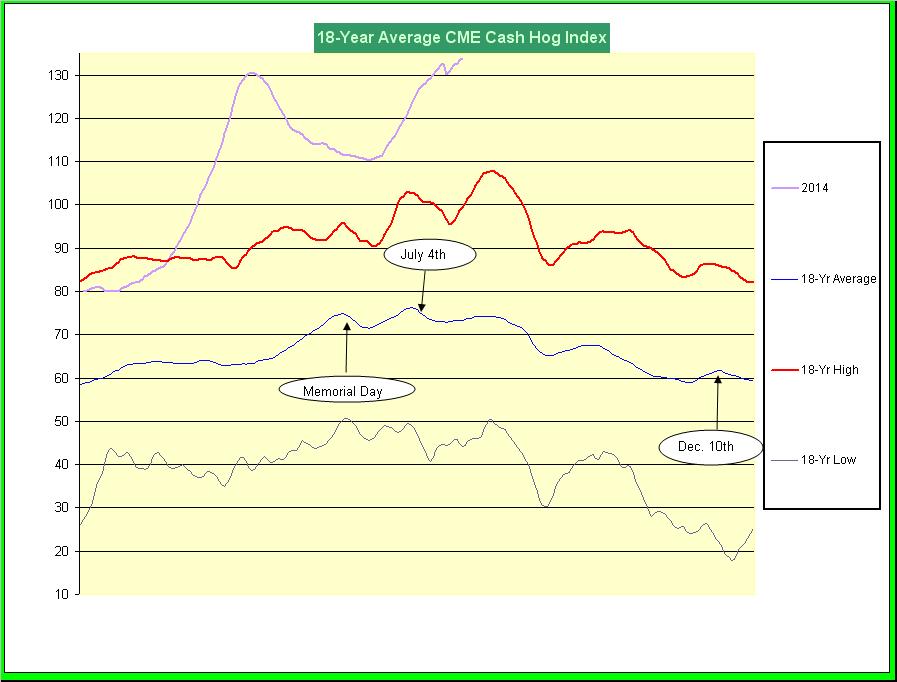

Currently the HEQ4 is discounted to the Index by -3.31. In the chart below, you can see that on average the Index tends to be fairly stable until the QQQs die, then it tends to taper off. With the kill coming in soft, beef being in short supply and the 6-day moving average carcass weights showing a little weakness, my bias is that packers will not have the luxury of cutting their bids until we see more hogs coming to market and the data seems to be saying that is down the road a ways. Therefore I want to buy QQQs and Q/V spreads on dips.

As you can see in the chart below, the CME Lean Hog Index is setting record highs this summer which is really not news.

Best wishes,

dhm

Messages In This Thread

- The Final Purchase Index for - - - *PIC*