MURICO.com Forum

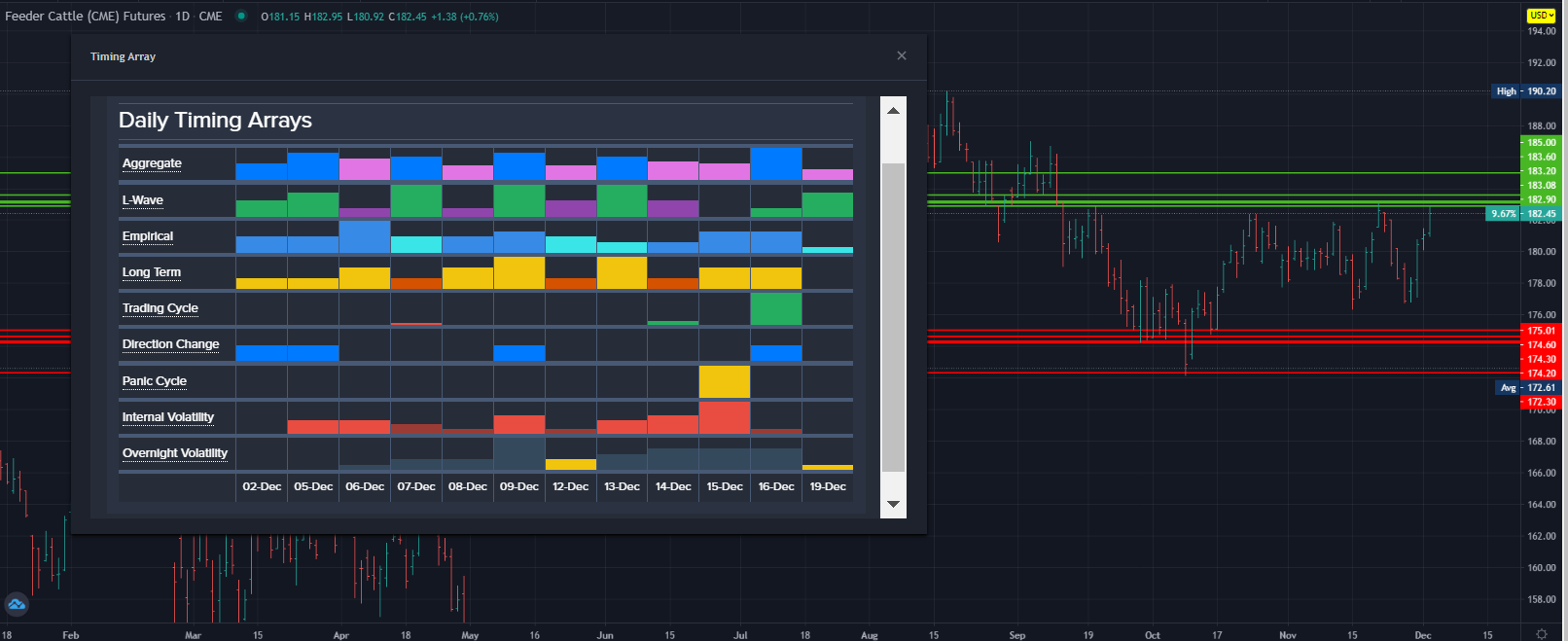

No high or low aggregate here...looks like it will be choppy by looking at the alternating colors on the aggregate.

Chart Text - Daily

The Feeder Cattle (CME) Futures has been in an uptrend for the past 4 days closing above the previous session's high by 0.54%. The broader rally has peaked with the last

high established at 18307 back on 11/21 9 days ago. We did elect 3 Bearish Reversals from this high. Clearly, this high was formed after a rally of 4 days.

Currently, the market is trading in a neutral position on our indicators but it is trading strongly higher up some 1.61% from the previous session low. Our projected target

for closing resistance for the next session stands at 18451, we need to close above that target to imply a further advance. Failure to even exceed this intraday warns that

the upward momentum is starting to decline. Moreover, a lower opening and a penetration of today's low of 18092 with a closing beneath this level would suggest today's

high will stand temporarily.

Nevertheless, this session closed below our ideal projection for closing resistance warning that the market which stood at 18306 is forming a high. A break of this

session's low of 18092 will warn that we have a potential temporary high in place. Our Stochastics are all pointing upward while our internal momentum models have also

remained in a bullish posture.

We see overhead projected resistance forming at 18708. Bear in mind that we have made a new low this week changing the Weekly Bullish Reversals once this week is

concluded. Still, this is important since this last low penetrated the previous low thereby this set of Bearish Reversals is more significant.

At the moment, the market remains bullish on the short-term levels of our indicators while the long-term trend and cyclical strength are bullish. At this instant, the

market remains within our trading envelope in a bullish position.

This market is also trading above the bank of eight moving average indicators also suggesting it is still above underlying support at this moment. The short-term

Stochastics are bullish but nearing a temporary overbought position soon on the horizon.

This market still has not yet exceeded the last key high of 18307 established back on 11/21. However, an opening BELOW 18194 in the next session would warn that the

high of this session may stand at least temporarily.

We did close below the previous session's Intraday Projected Breakout Resistance indicator which was 18277 settling at 18107. Nevertheless, this market closed above the

previous session's high warning it is not yet rolling over. The current Projected Breakout Resistance for this session was 18306 which we still closed below. The Projected

Breakout Resistance indicator for the next session will be 18451. Now this immediate indicator in the current trading session is above the current close offering projected

resistance. Therefore, we either must open above it and hold or close above it to imply the rally is still in play. Otherwise, failure to exceed 18451 during the next

session warns the upward momentum may be lost and a retest of support becomes possible.

Intraday Projected Breakout Resistance

Today...... 18306

Previous... 18277

Tomorrow... 18451

During the last session, we did close above the previous session's Intraday Crash Mode support indicator which was 17619 settling at 18107. The current Crash Mode

support for this session was 17968 which we closed above at this time. The Intraday Crash indicator for the next session will be 18069. Remember, opening below this

number in the next session will warn that the market may enter an abrupt panic sell-off to the downside. Now we have been holding above this indicator in the current

trading session, and it resides lower for the next session. If the market opens above this number and holds above it intraday, then we are consolidating. Prevailing above

this session's low will be important to indicate the market is in fact holding. However, a break of this session's low of 18092 and a closing below that will warn of a

continued decline remains possible. The Secondary Intraday Crash Mode support lies at 17037 which we are trading above at this time. A breach of this level with a

closing below will signal a sharp decline is possible.

Intraday Projected Crash Mode Points

Today...... 17968

Previous... 17619

Tomorrow... 18069

NEXT OPEN COMMENT

From a broader cyclical vantage point th

Messages In This Thread

- Feeders Daily *PIC*