MURICO.com Forum

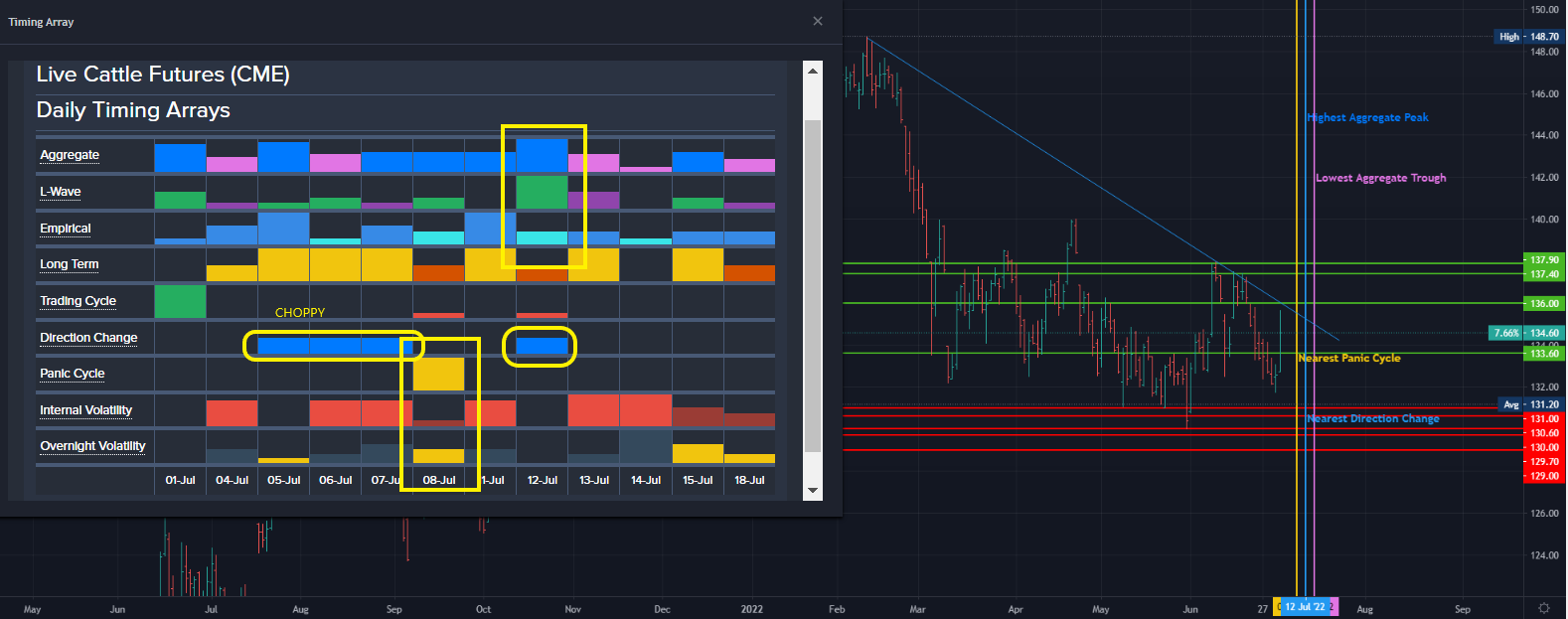

You can see where we elected that DBUR located at 133.60, that will disappear once I refresh the lines. Notice the downtrend line that price needs to get above in order to continue up. The next High Aggregate is on the 12th, there is a Panic Cycle on the 8th. Notice the 3 directional changes in a row...shows that it will be choppy.

The Cattle Futures (CME) has bounced to the upside for one session closing above the previous session's high quite significantly by 1.14%. The broader rally has peaked

with the last high established at 13795 back on 06/09 16 days ago. We did elect 2 Bearish Reversals from this high. Clearly, this high was formed after a rally of 7 days.

Currently, the market is trading in a neutral position on our indicators but it is trading strongly higher up some 2.99% from the previous session low. Our projected target

for closing resistance for the next session stands at 13960, we need to close above that target to imply a further advance. Failure to even exceed this intraday warns that

the upward momentum is starting to decline. Nevertheless, we have elected 1 long-term Bullish Reversal suggesting that the market should now rally from hereat least on a closing basis as long as it holds above 13270 intraday. As of now, we see overhead projected resistance forming at 13768. Bear in mind that we have made a new low this week changing the Weekly Bullish Reversals once this week is concluded. Still, this is an minor Bullish Reversal since we made a higher low. As of now, the market remains bullish on the momentum indicator yet neutral on the short-term trend indicator while the long-term trend is neutral and our cyclical strength is bullish. At this instant, the market remains within our trading envelope in a bullish position.

This market is also trading mostly above the bank of eight moving average indicators suggesting it remains in a mixed posture for now.

This market still has not yet exceeded the last key high of 13795 established back on 06/09. Theoretically speaking, the Downtrend Line technical resistance stands above

the market at 13693 which must be exceeded and then hold it as support thereafter in order to imply a breakout. Failure to sustain above this technical trend line will

warn that the market has only faded this projection. A closing back below it will warn of a retest of underlying support is likely. However, an opening BELOW 13418 in the

next session would warn that the high of this session may stand at least temporarily.

We did close below the previous session's Intraday Projected Breakout Resistance indicator which was 13341 settling at 13257. Nevertheless, this market closed above the

previous session's high warning it is not yet rolling over. The current Projected Breakout Resistance for this session was 13309 which we have now closed above suggesting

the market is starting to possibly breakout to the upside if it can be maintained in the next trading session. The Projected Breakout Resistance indicator for the next

session will be 13960. Since we have closed above today's number 13309, this implies a further rally in the next session if we at least open higher. We need to exceed

intraday and close above 13960 to imply a continued rally beyond the next session. Only if you open back below 13309 or close below it then the rally is losing momentum.

So, pay close attention to these projections for the next trading session. Remember, these are dynamic which will change with each session.

Messages In This Thread

- Cattle Array *PIC*