MURICO.com Forum

kill for 4/21/14 was down -2.06 to 103.97. The daily component has been down every day since it turned south on 7/16/14. Since that time it has dropped by 30.20 points. Producers who sold VVVs on 7/15/14 to hedge their fall shipments must be smiling big time with a 23 point hedge in place!

The -2.06 drop in the component on Thursday's kill was the biggest one-day drop we have had yet this fall.

The data I have collected from the USDA shows that the kill since 6/1/14 is running 6.36% below the same period last year. My read on the last H&P report suggests it should be down something like 4.0% to 5.0%. This may mean one of two things:

1. The USDA over-estimated the number of market hogs

Or -

2. Producers have fallen behind in their shipments and now have a few extra heavy hogs to ship.

If the H&P Report was correct, my hog pricing model projects that producers may be behind in their shipments by as much as 650K hogs.

With carcass weights running almost 10# heavier than one-year ago, there is a distinct possibility that producers have fallen out of currency in their shipments.

I think an extra 650K of hogs hurrying to market could burden prices a bit.

I say that because cut outs are not holding up very well. The heavy carcass weights have really taken the edge off the shortage of pork that might have developed because of the low kill rate.

Thing that I am wondering is, "Where is the Index going from here?"

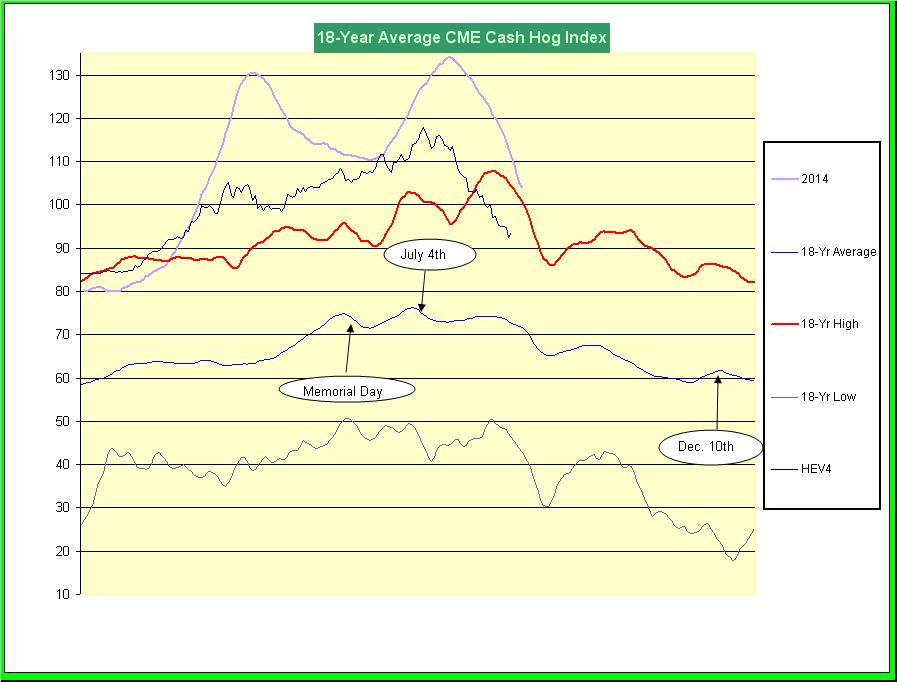

The chart below shows that on average the CME Index drops until about the middle of September then it has a tendency to rally a little before it begins the long fall decline.

There are several things that point to the possibility that the Index will follow this historical pattern and decline a bit more over the next couple of weeks:

1. Cut outs are not holding up very well suggesting weak demand.

2. Carcass weights are quite heavy suggesting that producers may be a bit behind in their shipments or at least have a fair-sized inventory of market ready hogs that could decide to hurry to market.

3. Packers seem to be shipping their hogs a bit faster than non-packers. I base this conclusion on the fact that the 6-day moving average carcass weight of packer hogs has declined more than the 6-day moving average carcass weight of non-packer hogs. Packers have a better information source relative to the supply of hogs than the rest of us and they may be seeing more hogs coming to market. This would make it a good idea to kill their hogs during a period of high prices then buy hogs cheaper as we move further into the high fall kill season.

4. Trends tend to continue and both cutouts and the Index are trending downward (But trends always end!)

5. Even though the index has declined over the past month, it is still 5.70 points higher than one-year ago and cutouts are 4.03 higher.

I am short a couple of VVVs, have scalped in and out of a couple of short V/Z spreads, have some short Z/G spreads from quite a bit higher than they are now and just bought some K/M spreads below 2.0.

I continue to believe that the hog market is unique amongst all the markets because of the large amount of fundamental supply/demand data available. This fundamental data is the basis for a lot of my trades although I realize that most traders are influenced by technical considerations so they cannot be ignored.

Historical spread patterns seem to have some significance, also..

Best wishes,

dhm