MURICO.com Forum

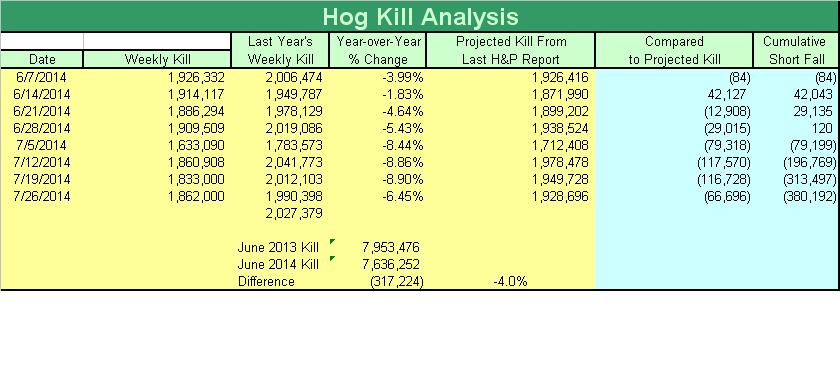

are not just a LITTLE bit surprising! They don't jib very well with the numbers I track from the weekly livestock kill reports. The table below shows that the kill for the four-week period from 5/31/14 to 6/28/14 was down 317K from the same period one-year earlier. That's a drop of 4.0% and it is spot-on with the last H&P report showing the 180# and up market hogs were down 3.99%.

I make a projection of what the kill should be based on the H&P projected inventory which I show in column 5 of the table below. For the four-week period ending 6/28/14 the numbers tracked extremely well as you can see in column 6 giving a cumulative kill difference from the projection of only 120 for the four-week period as shown in column 7.

Beginning with the week ending 7/5/14 there is a break-down of this harmonious tracking as you can see. By the end of the 8-week period ending 7/26/14 the kill was 380K below projection.

In struggling to find an explanation, I come up with a couple of explanations -

1. The USDA over-stated the number of hogs in producers' barns.

2. Producers have been withholding hogs from the market to add more poundage with the cheaper feed that is now available. The number withheld may be as many as 380K.

3. Some combination of a miss by the USDA and some producer foot-dragging with their shipments.

I suppose it is possible that the USDA understated the number of hogs in producers' barns and producers have been slow shipping hogs so we are now going to see a huge surge in the shipment of heavies as producers struggle to get current.

But I don't think this scenario is likely.

Lately the USDA reports have been quite good so the possibility exists that producers may have fallen out of currency in their shipments. If producers are a little behind in their shipments, they have not become motivated sellers yet. I say that because the swine scheduled for delivery report shows that packers had 3.1% fewer hogs scheduled than they had on this date last year although the falling CME Index may indicate that producers are becoming anxious sellers but it is not yet showing up as higher kill numbers.

I think emotionally I am wanting to have a bullish bias right now. I say that because I had a good feeling when I saw that cut out firmed a little yesterday.

The things that make me want to be bullish the QQQs are the fact that the scheduled numbers are trailing the year ago levels, historically the CME Index tends to hold up well until after the QQQs expire, the PED virus DID wipe out some piglets last winter and the QQQs are discounted to the Index by 6.40.

We generally don't see the Index collapse by that much this time of the year. In fact the most it has fallen in the last ten years from this date until the expiration of the QQQs was rate 4.18 in 2012 except for the 2009 disaster that saw the Index drop by 10.58.

Because of the tendency for the Index to hold up well until the QQQs expire and the possibility the producers may have fallen out of

currency, it seemed to me to be the right strategy to buy QQQs and sell VVVs so I have been scaling in and out of that spread. Thursday my profit targets were hit and I banked my profits and was left at the station yesterday when the train pulled out!

Best wishes,

dhm