MURICO.com Forum

Hi Dewey,

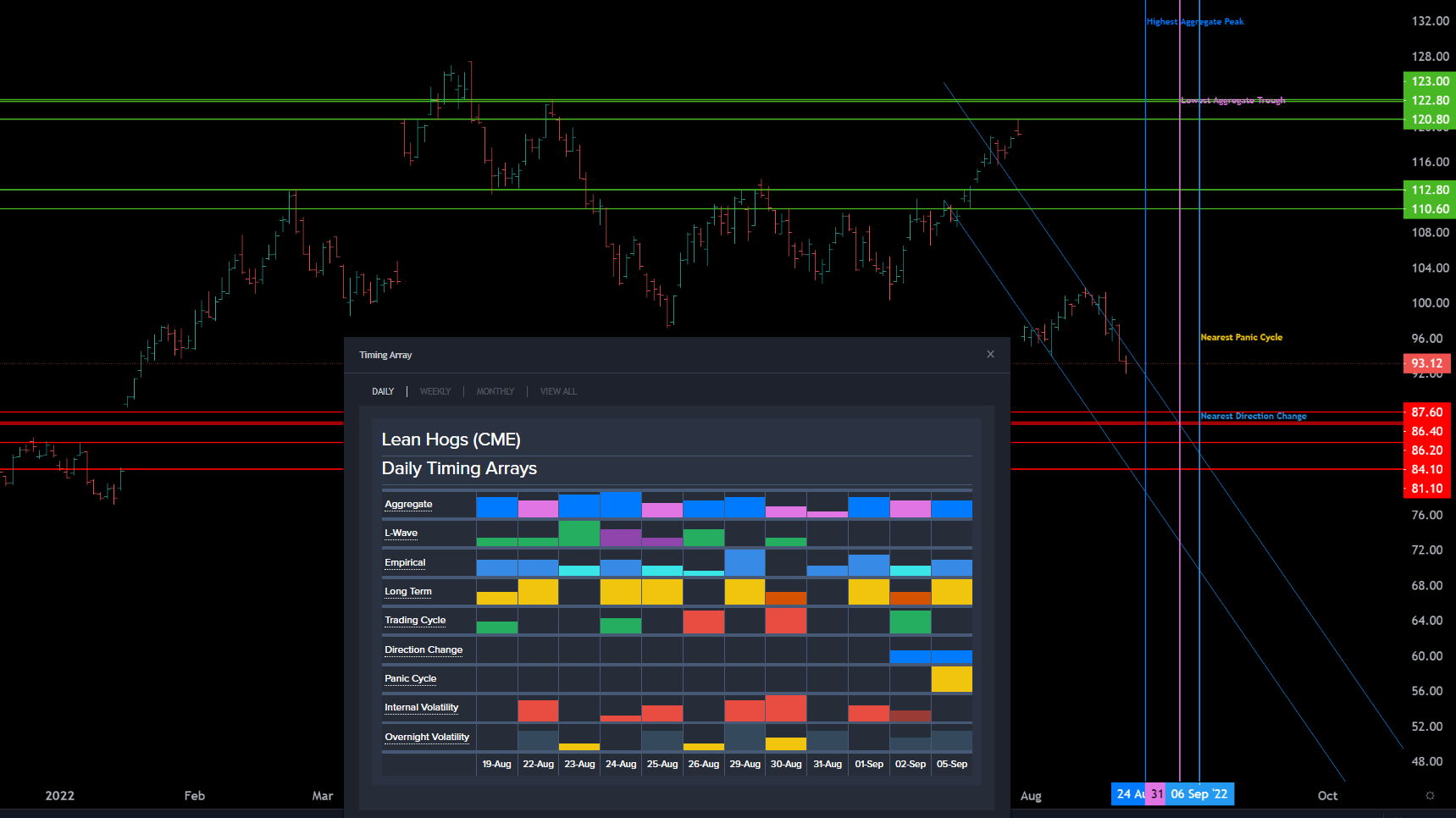

Front month October long time continuous chart. Looking at the array it seems like it is going to be choppy here, both green and red Trading Cycles. If price meets time then you will be looking for price to travel down into the 24th High Aggregate where you have a green Trading Cycle...so you would look for price to trade at the 87.60 with a possible bounce off the 3rd line at 86.20. There is no Directional change on the 24th so not sure if this is the big turn on the daily here. The Weekly chart had a directional change and a high aggregate for last week...with a Panic Cycle scheduled for this coming week. the Weekly time and price would be 86.04 on the 29th off the low aggregate.

From the daily text...

The Live Hogs (CME) made a new low today. Nevertheless, this market has not yet breached our underlying system

support levels. Interestingly, this market opened higher making a new low down 1.50% under the previous low which was

a sharp decline and then closed below that the previous low plunging significantly in panic mode again by 5.76% from the

previous session's high. This strongly suggests we are could be entering a potential crash mode position implying caution.

A break of today's low of 9190 during the next trading session will warn of a potentially serious decline ahead especially if

it closes below today's low again. The last important high was formed on Thursday July 28th at 12070 which was 16

trading days ago. Our projected support for tomorrow lies at 9173 and a break of that level can set in motion a panic to

the downside where extreme support lies at 9028. Hence, pay close attention at this time.

We did close below the previous session's Intraday Crash Mode support indicator at 9405 settling at 9330 which alerted us

to a further decline was likely going into the instant session. The immediate Crash Mode support for this current session

was 9163 which we have now closed back above suggesting the crash is subsiding. The Intraday Crash indicator for the

next session will be 9028. Now since we closed back above this indicator in the current trading session, then holding

above this indicator for the next session will imply the decline is subsiding. The Secondary Intraday Crash Mode support

lies at 6038 which we are trading above at this time. A breach of this level with a closing below will signal a sharp decline

is possible.

Intraday Projected Crash Mode Points

Today...... 9163

Previous... 9405

Tomorrow... 9028

This market has declined for 6 trading days since the last high established at 10165 from which we have witnessed a

decline of 9.59%. In the process, we have elected four Daily Bearish Reversals.

Granted, this decline has penetrated the previous key cycle low established at 9382 and it is sharply lower by 24% from

the last high made 07/28. This type of pattern warns we are in the throes of a near-term correction which is rather

serious at this moment.

Interestingly, this market has dropped for several days and closed below the previous low warning that the market is still

vulnerable. The projected extreme target support for tomorrow lies at 8881 which needs to hold on a closing basis to

imply a bounce can form thereafter.

Up to this moment in time, the market remains bearish on the short-term levels of our indicators while the long-term

trend and cyclical strength are bearish. This market is also trading mostly above the bank of eight moving average

indicators suggesting it remains in a mixed posture for now. The market is trading within our envelope albeit skewed to

the bearish side.

We did close below the previous session's Intraday Projected Breakout Resistance indicator which was 9896 settling at 9330 gesturing that the market is not in a

breakout mode at that precise moment. The current Projected Breakout Resistance for this session was 9789 which we still closed below. The Projected Breakout

Resistance indicator for the next session will be 9401. Now this immediate indicator in the current trading session is above the current close offering projected

resistance. Therefore, we either must open above it and hold or close above it to imply the rally is still in play. Otherwise, failure to exceed 9401 during the next

session warns the upward momentum may be lost and a retest of support becomes possible.

Intraday Projected Breakout Resistance

Today...... 9789

Previous... 9896

Tomorrow... 9401

Messages In This Thread

- Hogs Daily *PIC*